Equity Crowdfunding Directory—USA Not All Crowdfunding Sites Can Be Used for Raising Capital

Equity Crowdfunding Directory—USA: Equity-based crowdfunding allows people to invest in an early-stage, private company (a company that is not listed on any stock exchange) in exchange for equity (shares, or a percentage of ownership) in that company, though with restrictions. The so-called Title III allows issuers to raise funds online from ordinary people for investment purposes, not just accredited investors (the rich).

The Venture Founders Equity Crowdfunding Directory—USA is growing and I’d be pleased to hear if I have not listed a platform you know about. Equally I’m open to other suggestions for improving the Directory.

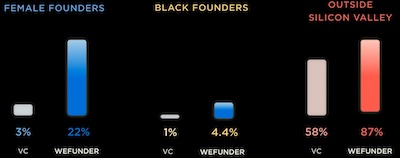

The leading equity crowdfunding platform, Wefunder, demonstrates how equity crowdfunding is radically changing the startup funding scene. The graphic hardly needs any words to tell the story.

Equity Crowdfunding—Study Before Jumping In

Crowdfunding is no easy route to equity raising. You should really learn about the process and the regulations, before trying to jump in. Wefunder has a place on its site where you can ask questions. Many other platforms have very helpful guidance. I would still suggest that you do your own research. Take a look at the Securities and Exchange Commission compliance guide on what is technically called ‘regulation crowdfunding’. The guide is for the platforms, but it will help you understand the process, despite the legalese.

An interesting development is that 30 States (as of January 2018) have adopted crowdfunding provisions in their rules or statutes recognizing that equity crowdfunding, done responsibly, with appropriate disclosure and safeguards, is another valuable tool that small companies can use to raise capital. This level is generally referred to as Intrastate Equity Crowdfunding). Eight more States have legislation pending or under discussion. Take a look at this Crowdfunded Insider article, and you can see examples listed below.

You might find the book, Equity Crowdfunding: The Complete Guide For Startups And Growing Companies, by Nathan Rose a helpful and not very expensive investment, the paperback is just $15.

Venture Founders Equity Crowdfunding Directory—USA

- Angellist: one of the oldest and most established equity crowdfunding platforms;

- Bioverge: a platform for investing in emerging healthcare startups that are changing lives;

- Circleup: for small consumer product and retail company fundraising;

- Crowdcube: raising funding from your own network of friends, family, customers and strangers;

- Crowdfunding NJ: an intrastate equity crowdfunding platform;

- Earlyshares: investment in private companies, real estate projects, and investment funds;

- Equitynet: has operated their business crowdfunding platform since 2005;

- Flashfunders: equity crowdfunding platform enabling anyone to own a piece of a company for as little as $50;

- Floridafunders: an intrastate equity crowdfunding platform;

- Fundable: business crowdfunding platform dedicated exclusively to helping companies raise capital;

- Fundify: a platform focused on projects that have a positive social impact, such as renewable energy, education, and healthcare;

- Fundersclub: for accredited investors with low investment minimums ($3k);

- Gridshare: brings together renewable energy projects, clean technology companies, investors and donors;

- Gust: funding platform for the sourcing and management of early-stage investments;

- Honeycomb Credit: local community loan crowdfunding;

- Localstake: does what its name implies—enables you to raise equity locally;

- Mainvest: a platform that enables local people to invest in Main Street brick-and-mortar stores;

- Michiganfunders: an equity crowdfunding platform open to Michigan residents to invest in Michigan firms;

- MicroVentures: a platform for both accredited and non-accredited investors access to invest in startups;

- NetCapital: Aims close the wealth gap in America by enabling everyone to invest;

- Nextseed: a Texas-based intrastate equity crowdfunding platform;

- Republic: a special focus on the underserved — women, minorities, immigrant and veteran founders;

- Seedinvest: equity crowdfunding platform opens up access to venture capital and angel investing to everyone;

- Startengine: do small and large online public offerings and also initial coin offerings;

- Unshackled: funding for immigrant founders;

- Wefunder: provides the opportunity to invest as little as $100 in startups: they are a Public Benefit Corporation. Their PBC Charter states, “We aim to increase economic growth and lower wealth disparity, by sharing the rewards of capitalism more broadly, and destroying the barriers that reduce social mobility.” They are far and above the leader in equity crowdfunding. Biggest market share in Regulation Crowdfunding—angel investing for everyone.

Other Sources of Startup Finance

Take a look at this post on Sources of Startup Finance for obvious & not-so-obvious ways to fund the startup, or the one on Bootstrap Finance for some others ways to go to fund the startup. Loans From Family and Friends is another way to go.