Family Offices and Venture Capital Founders Overlook a Source of Funding

Missed Opportunity for Startup Funding

Family Offices and Venture Capital: Founders of new ventures are frequently ignorant about an excellent source of equity investment: family offices. With good reason, perhaps. Family offices are private wealth management firms that serve ultra-high-net-worth investors.

Family offices are different to traditional wealth management firms. They offer an outsourced solution to managing the financial and investment side of an affluent individual or family. For example, many family offices offer budgeting, insurance, charitable giving, wealth transfer, and tax services to their wealthy patrons, in addition to managing investments. There are both single family offices (SFOs) and multi-family offices (MFOs).

Purpose and Profit in Family Offices

Relatively few family offices invest in startups and early-stage businesses. Those who do will probably focus on investments in specific sectors or types of startup. They are also likely to have a focus on achieving a well defined purpose, as well as profit, particularly the SFOs. Hence they will tend to have longer time horizons for exit strategies (patient capital, with an indefinite fund life). The Family Office Report for 2019 reports that over a third of them are now engaged in sustainable business and a quarter in impact investing.

Hence, you’d be well advised to want a genuine partnership with the family office and welcome one of their managers to your board. Be warned, though, that among the small number of offices that invest in startups, an even smaller proportion go for very new startups or those with a strong sense of purpose.

Family offices tend to be located in major cities, not just in the US. Even overseas-based offices may have significant US investment. Since they serve the ultra wealthy they are not into publicizing themselves. They value discretion and confidentiality above all, irrespective of how active they are in their investments.The pioneer among the family office field was John D Rockefeller. If you want to broaden your knowledge, try the Bloomberg report on the Future of Family Offices (2017), or Family Offices and Investing for Impact, which will give some insight into how some offices are beginning to bend towards making the world a better place.

However if you feel that it’s worth your while to find an office that could be interested in your startup, then try networking, because most family offices do not invite a direct approach. On the other hand, you can make an investment of $895 to buy the North America Family Office List from Family Office List.

Another source of data, information and contacts is Fintrx, but it too, is costly. It would save you a lot of time if you want to cut through a rather opaque part of the finance industry. You can also connect with appropriate nonprofits that are promoting, say inclusion in your industry, as does Project Include, whose mission is to give everyone a fair chance to succeed in tech. Another route could be to see what meet ups in your vicinity exist to discuss relevant subjects. Or go to events organized by a startup incubator near you.

Family Offices That Fund Startups

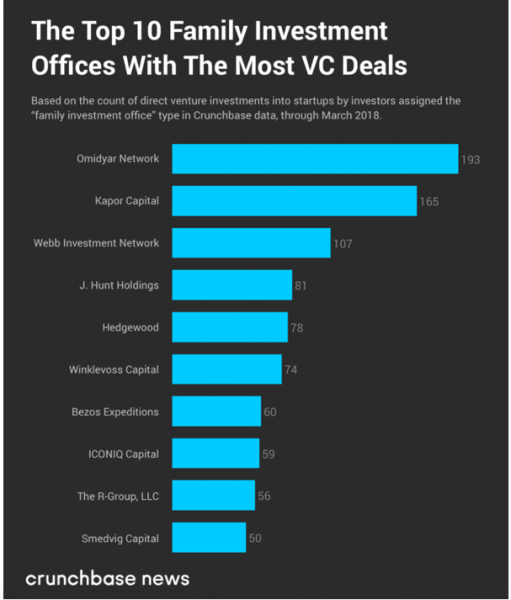

According to Crunchbase News, the top 10 American offices that do invest in startups (the ones with the most VC deals) are shown below:

You’ll find Bezos Expeditions makes very interesting reading. We hear a lot about Jeff Bezos, but not so much about his family office. There are many others, but they may take some hunting down. You’ll want to look closely at their stories and the specializations that they have. A couple of examples are Sculley Brothers (John Sculley was CEO of Apple from 1983-93) and the Pritzker Group.

I suggest that you visit the Omidyar Network website, since by reading it, you will find some exciting ideas and projects that are reinventing the future. The ON focuses on Re-imagining Capitalism, Beneficial Technology and Discovering Emergent Issues.

In any event, I suggest you do plenty of homework before you embark on a quest for funding from family offices. You will need to build a parallel network to those of the family offices themselves. The network will be largely people already in finance. They may become your advisors or board members, for instance from among acquaintances from college days, club memberships. I know it sounds like an ‘old boys’ network, so you may want to try a different route, such as conference attendance.

Dealing with the 1%

You’ll also need to be happy with the fact that, if you are going to raise capital from a SFO or MFO, you are almost certainly going to be dealing with the 1%. This may sound like prejudice, but your financial partners should be ones with whom you share values. You may also need to take care that the office you select does not do things or invest in sectors of which you disapprove.

Some offices appear not to have websites, nor make any effort to communicate by other means. However, you can find out which ones belong to the elite group of billionaires who have made a public declaration that they would like to see much higher taxation of the 1%. In the table above, Pierre Omidyar, is one of their number. So are Warren Buffett and Bill Gates, both of whom signed the Giving Pledge to donate half of their fortunes. So did Ray Dalio founder of Bridgewater Associates, who last year described the wealth gap is a national emergency.

Mission Driven Capital Sources

There are an increasing number of sources of mission driven equity investors. There is a list of over 80 mission driven capital sources here on Venture Founders. I have loosely categorized their characteristics to guide you, but you’ll need to spend time on their individual websites at least, before you decide to make an approach.

You will gain a lot from reading Steward-Ownership: Rethinking Ownership in the 21st Century. It will provide much information that you will be able to use in your quest for purpose driven family offices. And you may even decide to take your startup down the steward ownership route. Steward Ownership follows two principles:

Profits serve purpose: For steward-owned companies, profits are a means to an end, not an end

in and of themselves. All the profits generated by the company are either

reinvested in the business, used to repay investors, shared with stakeholders,

or donated to charity.

Self governance: For-profit businesses are often beholden to the interests of shareholders who

aren’t involved in the operation or management of the business. Stewardownership

structures keep control with the people who are actively engaged

in or connected to the business. Voting shares can only be held by stewards,

You may also develop your knowledge by reading Funding the Benefit Sector. Social (nonprofit) Private![]() (business), or Public (government), sectors or a combination, or hybrid of them can all be part of the Benefit Sector.

(business), or Public (government), sectors or a combination, or hybrid of them can all be part of the Benefit Sector.