Side Business to Startup Safe way to learn what works before launching the new venture

Side Business to Startup: About 57 million Americans have a side business, in addition to their regular paid employment. That amounts  to nearly half of American full time workers who have a side business, as revealed by the Hartford’s 2018 Side Business Survey. According to the Global Entrepreneurship Monitor 2018, 57% of Americans considered that they had the capability to start a business. A 2013 GEM Report found that 69% of founders started their business at home.

to nearly half of American full time workers who have a side business, as revealed by the Hartford’s 2018 Side Business Survey. According to the Global Entrepreneurship Monitor 2018, 57% of Americans considered that they had the capability to start a business. A 2013 GEM Report found that 69% of founders started their business at home.

Not all side hustlers are taking the first step towards setting up in business full-time. Most (61% according to the Hartford survey) have a side business for financial reasons. Many are doing it just to stay afloat. Others need the money to boost their savings, to be able to have a few luxuries, or to pay for their kids’ college. However they could, all 57 million, could be called solopreneurs.

Many reasons to choose a side business to startup

However, those people who do have a startup in mind, choose this route for many different reasons, including:

-

the startup idea can be tested, with low financial risk;

-

gauge the best time to quit full time, but about 1/3rd can’t afford it/give up benefits;

-

salary not keeping up with inflation, but 48% say they could not make a living at it;

-

a preference to be autonomous (no boss);

-

a test for changing career direction;

-

discover if the entrepreneurial life will be right for you and family;

-

work on a passion with its own reward, but only 9% do for that reason.

The choice of this voyage to new venture creation makes a lot of sense, if you can manage the delicate balance of being committed to your employer, while at the same time providing a quality product or, more likely, a service, to your side business customer. Let alone preserving your relationships at home.

A side business or a fully-fledged enterprise?

You have a choice to make the side business a real enterprise, a way to earn extra money, or just a hobby for which you get paid. There’s no criticism to be made if it’s just a hobby, because you love doing it. Even stamp collecting can be remunerative.

If it’s a real enterprise, on the other hand, it will be important to be disciplined to avoid going mad or killing domestic relationships. Discipline will involve writing some statement about the aims of the side ‘enterprise’. You need the words/data, at least to make sure you have left nothing out or as a baseline to check progress for yourself; to share with others for feedback; or to build into a fully fledged business plan if the side business takes off.

Self organization will have benefit to the side business, but it will also give you other advantages that you may not have thought about:

-

as a way to avoid falling overboard with stress;

-

clarity of purpose may help your spouse join you, of at least understand your stress;

-

a means to reveal your personal weaknesses (and how to complement your strengths);

-

be clear about your purpose and what you are offering.

Financing the side business to startup

Wow, there are lots of options for early stage funding! Remember, chances are high that if you managed your side business well, you may not need that much money to get going. Anyway in 2018, 42 % of Inc. 5000 CEOs responding to Inc’s annual survey said they used under $5,000 to launch their businesses (including ones who went from a side business to startup).

Here are some of the most common sources of finance for startups:

-

Traditional finance: Dig into savings? Probably not a good idea. Bank loan? I do not recommend it, because the interest is likely to be high for an as yet untried business. Credit cards? Definitely not.

-

Financial bootstrapping: you’ve heard of it, but probably have not realized how many options you have. When I started my main business nearly 40 years ago, I had never heard the bootstrapping term, but that’s what I did. I ran a subsidiary of an international firm and when I announced my departure, I realized that they would be stuck with an office lease, so we took it over with all the furniture, office equipment, vehicles and the like. I paid of the total value over the next twelve months. We got a revenue-based business loan—fixed against our sales projections and if we did better the bank gained, but if we overestimated, we won. We started with a former colleague, my wife and one recruit. We had ‘pre-sold’ three clients who produced revenue from Day One, and who continued with us post startup. One was known to be a good reference for potential future sales. Of course we watched cash flow and never went into the red at the bank.

Financial bootstrapping: you’ve heard of it, but probably have not realized how many options you have. When I started my main business nearly 40 years ago, I had never heard the bootstrapping term, but that’s what I did. I ran a subsidiary of an international firm and when I announced my departure, I realized that they would be stuck with an office lease, so we took it over with all the furniture, office equipment, vehicles and the like. I paid of the total value over the next twelve months. We got a revenue-based business loan—fixed against our sales projections and if we did better the bank gained, but if we overestimated, we won. We started with a former colleague, my wife and one recruit. We had ‘pre-sold’ three clients who produced revenue from Day One, and who continued with us post startup. One was known to be a good reference for potential future sales. Of course we watched cash flow and never went into the red at the bank. -

Crowdfunding: You have heard it and may possibly have used it. Remember there are three main kinds—rewards, donation (almost only for nonprofits), and equity. Each has advantages and the reverse. Rewards may not suit your product or service, but if it does, go for it. Equity-based is great, but remember it will dilute your personal equity

-

Person-to-Person (P2P) loans: They involve individuals lending personally to the startup and don’t involve equity, but they have to be repaid regularly. There are lending platforms like Prosper, and Lending Club. Conditions are strict, but if you are a good risk you can get one at as low a rate as 7%, but most are a good bit higher than that.

-

Friends, family, and business associates like suppliers, who want to see you succeed, because they benefit, too. They are said to amount to tens of billions of dollars a year. This a tricky source of finance, because your personal relationships are involved, so you must make sure you sign a promissory note, which sets out terms and conditions. Be very careful that the lender knows the risks and tax implications.

-

If you do a side business to startup route, you can probably forget Angel Investors. You are unlikely to have the scale to interest them. Don’t even give Venture Capitalists a second thought. At least, not yet.

-

Grants and prizes: It sounds like free money. Well, it may not be all that free, since you will have to be distracted from your main purpose to complete applications for grants (and there may be some quid pro quo, like to locate your startup in a particular location). To win prizes is no sure bet, and you’ll have to do a lot of work to win one. In the case of an application to a Business Accelerator, which may produce an investment, you will need to follow the program that may need your undivided attention for 3-6 months. Also they probably won’t look at you closely until you have gained a bit of traction.

How much do you need for going from a side business to startup

It will not be just the simple figure itself—the consequence of working out a startup budget, both before starting the side business, and then for the startup itself.

You need to figure out how much should be cash in the bank and the speed with which you’ll use it/get revenue (cash flow forecasting). This will immediately take you into things like:

- pricing your product/service;

- necessary equipment for the side business and the startup. Be careful not to use any assets or services of your full-time employer;

- what production/servicing/outsourcing costs will be incurred;

- marketing costs for the side business (if your boss does not know, it will have to be a bit covert (can marketing be covert?). For instance, is it wise to circulate printed stationery, if you have not yet told your employer. On the other hand there are some things you can do at virtually no cost, like blogging or posting on LinkedIn or Craigs List (do you use your own name or your future business name;

- marketing costs before and after you press the startup button, like designing the website before and having it hosted after;

- networking: you’ll need to account for travel and incidentals. Can you do a blog in your own name and introduce a trade/company name after the startup launch;

- you’ll likely have admin costs (before/after), like: registration, even it’s only a matter of DBA (Doing Business As), tax advice, local planning restrictions that may apply and the consequences

Best accommodation for business to startup

The least expensive place to start is probably from home, provided you have a space—not the living room or bedroom. The best however may be away from home. You should be able to find a coworking space  within striking distance from home. The advantage is that you can use them flexibly. You can graduate from simply using one as a business address, to ‘hot-desking’ (using a desk and facilities as and when you need it. From there you can graduate to a dedicated personal desk available to you at any time (or more than one if you have co-workers. The ‘top of the line’ is a dedicated office exclusive to your business. Costs vary widely both by what option you choose to what facilities the location offers. The range is likely to be between $150-1,000 a month.

within striking distance from home. The advantage is that you can use them flexibly. You can graduate from simply using one as a business address, to ‘hot-desking’ (using a desk and facilities as and when you need it. From there you can graduate to a dedicated personal desk available to you at any time (or more than one if you have co-workers. The ‘top of the line’ is a dedicated office exclusive to your business. Costs vary widely both by what option you choose to what facilities the location offers. The range is likely to be between $150-1,000 a month.

Think carefully about the alternatives: working from home or in a place where there are office-like facilities and the networking opportunities of co-working. Consider the consequences both for yourself and those with whom you live.

Fun stuff before you get too deep into a side business to startup

You will want to think about personal branding. Are there possibilities to make presentations at conferences, seminars at the local Chamber of Commerce, writing and publishing articles in relevant media, for example? Could you teach an evening or an online course? How will you build up a prospect mailing list (should you buy CRM software?).

How are you intending to have a mailing list, if so, can you link it to a blog? What stuff can you share with people on the list. Could your trade or professional association help build it. Phew! When will you have time for all this?

There is one big thing that could either be fun or disruptive. Are you going solo or will you seek a co-hustler? Is this the big opportunity for your spouse or family members. Think about opportunities and the extent to which you are compatible in work, and whether you have overlapping/complementary skills and experience.

My main business was started with my wife. We were not so much complementary in the skill department, as in personality. She had never been in business and she brought a fresh look at things I considered ‘given business wisdom’. She found herself to be a born sales person, mainly through her social awareness and relationship style. Both of us had pushy personalities and always knew best. By the time we’d been in business for several years, we asked our colleagues and staff if they had difficulty with the two owners regularly disagreeing in public… and to our surprise, they said it helped them see the two sides of every difficult issue that arose!

Side business to startup—out in the open or under the radar

This relationship will vary widely depending upon you and your boss. I was lucky to have a boss (and company) who was understanding to the point of being supportive. We had tried the phantom stock‘ route and it had not worked for us. It was clear that ultimately I would resign, when I had some clients, so my boss decided it was best for us to remain on good terms and the subsidiary I ran could be closed with minimum or nil cost—and that’s what we achieved. I was fortunate.

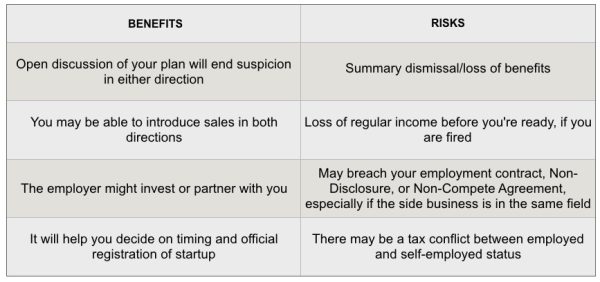

If you are not as lucky as I was, then you may want to avoid informing your full time employer about your intentions. You’ll need to balance the benefits with the risks having it out in the open or (trying to) fly under the radar.

Benefits and Risks of Telling Your Boss

You need to take a critical look at your intentions. I suggest using the 5 Whys technique to get to a point where you are clear about the potential consequences of being open with your boss—both benefits and risks. Think about timing, too—when would be a good time from the boss’s point of view as well as your own.