Startup—Small Is Beautiful Extractive or Productive

Startup—Small is Beautiful: Mindful entrepreneurs scale to the right size for good. Investors seek scale fast to maximize investment. Over rapid growth may create problems for founders, above all those such as inadequate cash flow or liquidity (most pundits say #1 reason for startup failure is running out of cash). Another super-fast growth problems could be a management system or recruitment process that expands too quickly. Manufacturing and distribution processes may not adapt fast enough, let alone pressure on accommodation and facilities, customer acquisition, supply chains…

maximize investment. Over rapid growth may create problems for founders, above all those such as inadequate cash flow or liquidity (most pundits say #1 reason for startup failure is running out of cash). Another super-fast growth problems could be a management system or recruitment process that expands too quickly. Manufacturing and distribution processes may not adapt fast enough, let alone pressure on accommodation and facilities, customer acquisition, supply chains…

Entrepreneurs have steep learning curves and need to ‘bed in’ their policies, practices and behaviors. Scaling too fast also rapidly increases the chance of early failure. In my own case, we spent the first two years ‘bedding in’ and consolidating our growth slowly and surely, though it did not feel like it at the time. We did not move into profit until our third year, by which time we had learned from many mistakes.

Small businesses—there are 33 million of them in America, half of which have fewer than 4 employees. Small businesses employ nearly half of the American workforce, and represent 43.5 per cent of America’s GDP. They also amount to 99.9 per cent of all businesses in the US. Take a quick look at the Pew Research Center’s research on small businesses. Wealth is seldom at the forefront of these entrepreneurs’ minds, but survival is.

Purposeful Startups Crave Meaning Not Growth

“It is not wealth that stands in the way of liberation but the ed attachment to wealth; not the enjoyment of pleasurable things but the craving for them,” said EF Schumacher in his seminal book, Small is Beautiful—a study of economics as if people mattered.” Startup founders can make a huge collective impact on society if their startups are based on the purpose of the achievement of well-being, rather than rapid growth.

attachment to wealth; not the enjoyment of pleasurable things but the craving for them,” said EF Schumacher in his seminal book, Small is Beautiful—a study of economics as if people mattered.” Startup founders can make a huge collective impact on society if their startups are based on the purpose of the achievement of well-being, rather than rapid growth.

I was fortunate enough to meet the author briefly at the end of the 1960s (the book was first published in London in 1973). He was chief economic advisor at the National Coal Board, when I was a senior civil servant at the National Economic Development Office—both axed by Conservative Prime Ministers.

Fritz Schumacher developed the idea of Intermediate Technology—appropriate technology for developing countries. He also espoused the concept of Buddhist Economics—to give people a chance to use and develop their faculties; to enable them to overcome ego-centricity by joining with others in a common task; and facilitating them to create products and services for a good life. He was talking about ‘Right Livelihood’, or the ethics of earning a living.

Relationships in startups need to be nurtured, both inside and outside the business. Chances of successful ones are much enhanced in small business if relationship is a high priority. According to British anthropologist Robin Dunbar, there is a ‘magic number’ of people with whom we can maintain successful connections at the same time. Dunbar and his colleagues applied this basic principle to humans, through examining historical, anthropological and contemporary psychological data about group sizes, including how big groups get before they split off or collapse. Dubbed Dunbar’s Number, it’s about 150.

Stakeholder Value or Shareholder Value

Marjorie Kelly, the author of 2023 book, Wealth Supremacy: How the Extractive Economy and the Biased Rules of Capitalism Drive Today’s Crises, says “Wealth supremacy can be defined as the cultural and political processes and attitudes by which persons of wealth accumulate and maintain prestige, privileges, and power that others lack.”

of Capitalism Drive Today’s Crises, says “Wealth supremacy can be defined as the cultural and political processes and attitudes by which persons of wealth accumulate and maintain prestige, privileges, and power that others lack.”

This definition is frequently echoed in descriptions of present day billionaires and when Marjorie Kelly refers to “the unseen underside of wealth and how it’s about extracting from the rest of us”, she is talking particularly accumulated wealth rather than about income earned in employment.

Accumulated wealth that is protected and increased by the much debated concept of the ‘fiduciary duty’ of shareholders, and frequently by those who manage the ‘investments’. The term has been weaponized by individual shareholders, corporate boards and asset managers, as described in Chapter 5 of Wealth Supremacy, the subtitle of which is “The Myth of Fiduciary Duty”. Marjorie Kelly makes reference (page 68) for example, to managers who say “sorry, hands are tied’, such as it might be in a negative response to those seeking to introduce or retain Diversity, Equity and Inclusion (DEI) policies in companies.

Corporate Governance1 is the system of rules, practices, and processes by which a company is directed and controlled. Establishing and implementing these practices involves balancing the interests of a company’s many stakeholders. Governance takes many forms and can be determined both through policy and legal means. The kinds of policy could include those for ESG (Environment, Social and Governance), or DEI. The company’s legal registration can include many definitions of governance depending upon the company structure. My last company was an LLC (one of the 81 Founding BCorps). The articles in the Operating Agreement (filed with the State) covered not only structural and financial provisions, but also Policies on Stakeholders, Community Service, Local Purchasing and others.

While they do not represent a large proportion of large companies at present, there are several corporate registration structures that are growing to meet the needs of both startups and established companies. One is the Public Benefit Corporation is a type of for-profit corporate entity whose goals include making a positive impact on society, that exists in 36 States of the US so far. Ordinary corporations may change to a benefit corporation merely by stating in its approved corporate bylaws that it is a benefit corporation. Another form is the Perpetual Purpose Trust—a financial tool designed to achieve specific objectives, rather than benefiting individual beneficiaries/shareholders. As well as managing companies, they can hold assets for charitable causes. Yet another is to start a Worker Cooperative or an Employee-OwnedCompany. The latter can also be created by setting up and Employee Share Ownership Plan, frequently used as a exit method for founders.

Extractive or Productive Economy

The Federal Reserve Bank of St Louis reported in the second half of 2024, that the top 10 per cent of US households by wealth had $6.9 million on average. As a group, they held 67 per cent of total household wealth. The bottom 50 per cent of households by wealth had $51,000 on average, who held only 2.5 per cent of total household wealth.

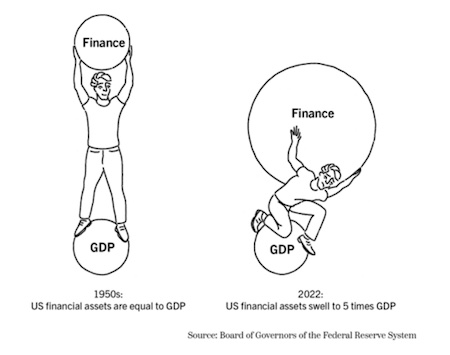

US financial assets have ballooned 5 times between the 1950s and 2022 while compared with GDP. Even if you believe GDP is a good measure of socioeconomic success, those assets have actually extracted value from the vast mass of the US working population.

Members of our society are very much interrelated. Domination by one very small group is counter-productive. Interrelated people who share values, on the other hand, normally lead to shared value. The late Ruth Bader Ginsburg put it rather succinctly: “There can be a happy world and there will be once again, when men create a strong bond towards one another, a bond unbreakable by a studied prejudice or a passing circumstance.”

Taming the Octopus

Kyle Edward Williams in his book, Taming the Octopus: The Long Battle for the Soul of the Corporation, says, “Americans have long been conflicted, confused, and often anxious about the entity known as the corporation. Frequently infatuated with the size and power of big business, Americans have also been deeply fearful and suspicious about it.”

“Americans have long been conflicted, confused, and often anxious about the entity known as the corporation. Frequently infatuated with the size and power of big business, Americans have also been deeply fearful and suspicious about it.”

Now more than ever, the intimacy between big business and government was summed up by Williams quoting James Madison in 1827 that big businesses may “be useful, they are at best a necessary evil only.”

The author refers a lot to the financialization of business where every asset “must be lean, mean, and flowing with cash, its status subject to the quarterly earnings call and a few simple metrics such as the return on investment and share price… Increasingly, management had stock options and other incentives that made it more invested in the interests of stockholders.”

Right Size Is Good and Startup—Small Is Beautiful

Of course, small business does not work well for building ocean liners, or mass production vehicle manufacturing, so big business is not about to disappear. For the rest of us entrepreneurs, figuring out the right size for our venture is vital if we are to flourish. It may be that your venture needs more, less or different people. It may involve re-organizing in the light of shifting tastes in the market, or changing technology.

Rightsizing is not necessarily restructuring or reducing the workforce; it may be a matter of increasing it. The right size for your startup may not be apparent before Day One; it may only be clear once you’re in operation or past the early days. It may depend upon the business structure, polices—or the fundamental aims and the nature of the industry you’re in. For instance, the kinds of things that may influence choice of size will include: if you intend from the start or eventually to be an employee-owned company; the nature of shareholding structure, eg family involvement; a desire to remain located in a small town with a limited pool of appropriate talent; company style, for example participative management; maintaining a personal relationship with staff, clients/customers.

Think about trees! What? Yes, trees instinctively know the right size to be. Different tree species have different growth habits and sizes. Many factors influence the height or spread they will reach. Oak trees can reach 100 feet or more, dogwood only makes about 10 feet. Different species grow at different rates; oak is slow, sequoia even slower, but poplar or will grow much faster. Environmental factors are a big determinant of size: water, sun, spacing, soil, climate, nutrients and temperature.

Think about trees! What? Yes, trees instinctively know the right size to be. Different tree species have different growth habits and sizes. Many factors influence the height or spread they will reach. Oak trees can reach 100 feet or more, dogwood only makes about 10 feet. Different species grow at different rates; oak is slow, sequoia even slower, but poplar or will grow much faster. Environmental factors are a big determinant of size: water, sun, spacing, soil, climate, nutrients and temperature.

Thoughtful management by people is a huge influence, for example a bonsai takes minute pruning: by cutting back new growth and shaping the canopy, smaller, denser growth is fostered. Restricting and trimming the roots will both control growth and maintain quality. Leaf care is critical to the tree’s ability to flourish.

Determine the Right Size for Your Business

The right size is important not only to the entrepreneur and her staff, but  also to customers, the community, and other stakeholders. If you look at presentations to finance institutions and venture capitalists made to raise equity, you will almost certainly see graphs showing wonderful growth prospects for the firm.

also to customers, the community, and other stakeholders. If you look at presentations to finance institutions and venture capitalists made to raise equity, you will almost certainly see graphs showing wonderful growth prospects for the firm.

The reality is virtually never like the chart of unremitting financial growth and success. So many factors prevail, even down to the business climate of where the startup is located.

For instance, the availability of venture capital is very unevenly distributed across the nation. At the time of writing, for instance, California corralled nearly 60 percent of American VC finance in Q12024. My State of New Hampshire cornered less than one per cent. There are many entrepreneurs who face other circumstantial barriers that are not about the quality of their individual startup skills, or their likelihood of success.

If the dominant focus is on growth, chances are high that your startup will have neglected other factors that will impede your journey to a flourishing enterprise. Venture Founders offers a great deal of practical advice about how to approach the strategy for growth scale and speed. Here are some you might like to look at:

- Startup Citizenship—Enterprise & the Common Good

- Startup Ecosystem—the Big Picture

- Stakeholder Business Thrives

- Purpose Driven Startup Coherence

- Stakeholder Strategy Evaluation Tool

- A good definition can be found here: https://www.investopedia.com/terms/c/corporategovernance.asp.