Breakeven Analysis for Entrepreneurs Calculate Your Startup's Move Into Profit

Breakeven analysis for entrepreneurs sounds very dry and like hard work for the founder who’s in love with her idea. But I found it one of the most useful bits of financial calculation, especially during the first two years of the business. We had to hold our breath and cling on to cash flow to stay alive at the beginning, but to have an aspiration and plan for becoming profitable one day was critical.

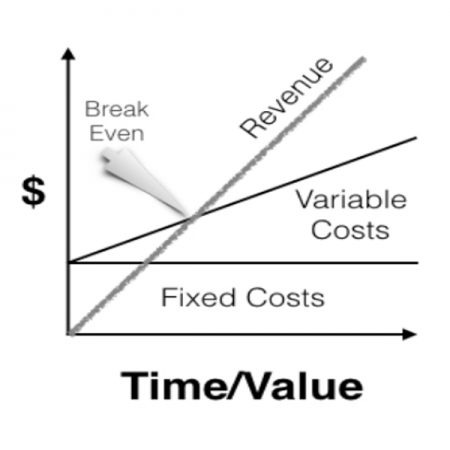

Breakeven analysis for entrepreneurs is used to determine when the business will be able to cover all its fixed and variable costs and begin to make a profit. Breakeven Analysis is important to identify your startup costs, which will help you determine your sales revenue needed to pay ongoing business expenses.

In my own case, profits did not materialize until the beginning of Year 3. Even then top line growth preoccupied our financial thinking for another year or two. Even then and always in our minds was that lovely graph you see here.

Keep Paying Attention to Breakeven Analysis

In the breakeven graph, note that as revenue increases, your variable costs (like raw materials or advertising) also go up. Of course you spend a lot of time worrying about fixed costs and especially if you are bootstrapping the business, but those variable costs can run away with you if you are not paying attention.

Some spectacular early business failures can be attributed to growing too fast. The Kauffman Foundation and Inc. Magazine conducted a study of companies five to eight years after being featured on the magazine’s list of the 5,000 fastest-growing companies. Two-thirds of the companies had either shrunk in size, gone out of business, or been disadvantageously sold.

What you can also do, using breakeven analysis is to determine, especially is the early days, how the numbers associated with each line over time are better or worse than predicted. Since you need to generate enough revenue at least to cover your costs to stay alive, your eye should be on positive cash flow, but this alone may mask whether you are headed towards profitability in the future.

Breakeven Analysis for Entrepreneurs Determines the Number of Units to Sell for Survival

Naturally you’ll be seeking to sell as much as you can. Breakeven analysis can tell you how many units of a product must be sold to cover the fixed and variable costs of production. It applies equally to service businesses, but you need to consider how to count a unit such as billable hours.

Naturally you’ll be seeking to sell as much as you can. Breakeven analysis can tell you how many units of a product must be sold to cover the fixed and variable costs of production. It applies equally to service businesses, but you need to consider how to count a unit such as billable hours.

You should also be monitoring the contribution margin equation that looks like this:

revenue per unit – variable expenses per unit = contribution margin per unit

This calculation helps you consider the relative contribution of individual products, which might otherwise be masked—advice comes from a non-financial entrepreneur.

As you think about doing calculating your breakeven point, you might want to reflect on:

- Expansion or Extension—discussion about the speed of growth and how to do it right;

- Reducing Risk to Startup Safely—dealing with the downside, too;

- Variance Analysis—determine how well you’re keeping to plan

- and there are many other tools that will add to your ability to manage the process in the Tools Section and in the Strategy Section of Insights.

It would probably be helpful to read the eBook, Founders Stay Afloat—by tracking 25 vital facts and figures. You can download it for free, simply by signing up for the periodic newsletter from Venture Founders that keep you up to date with the posts in the last month, new directories and the like.