Startups Need Data Focus On Vital Information

Startups Need Data: Many advisers will counsel budding startups to use national economic and market data to plan their new  enterprise and be sure of realistic opportunities. This can be good advice for entrepreneurs planning high-risk tech ventures or major manufacturing investment, that need big chunks of capital. It will also be true for aspiring unicorns—the startups seeking venture capital backing that aim at billion dollar valuations after an IPO.

enterprise and be sure of realistic opportunities. This can be good advice for entrepreneurs planning high-risk tech ventures or major manufacturing investment, that need big chunks of capital. It will also be true for aspiring unicorns—the startups seeking venture capital backing that aim at billion dollar valuations after an IPO.

For ordinary mortals, including the 99 per cent of founders who do not get venture capital, need much more specific data, relative to location, sector, target markets, or identified opportunities. Macro data is helpful to know, maybe, but not specifically to inform entrepreneurial decision making.

There will be no certainty about your chances, be cautious about data overload. Just as you will not have a perfect prototype pre-launch, you will not have perfect data. I know of many planned startups that never started, because of too many prototypes and too much data. Go for a minimum viable product (MVP), a version of a product with just enough features to be usable by early customers who can then provide feedback for future product development. A useful way to approach data and get started is to use the Business Model Canvas. Another useful tool at this stage could be the SWOT Analysis, which will help clarify the startup’s Strengths, Weaknesses, Opportunities and Threats, hence where data will help.

My first business was planned in 1981 and launched in 1982. At that time, the 1981-82 recession was the worst economic downturn since the Great Depression. We were undaunted, because our specialist B2B was based on careful study of our particular product market opportunities, not aggregated national data. We knew about the prevailing economic atmosphere, but we were going for a very closely defined group of customers, by ownership, spending patterns, reputation and other variables related to our products.

Here are three sets of national data that may be good to know in a general sense, but probably will not help critical decision making for entrepreneurs considering timing or chances for successful startup. Focus on specifics, not generalities!

Quantitative or Qualitative Data—Which Do You Need?

The simple answer is both! You are likely to have been collecting qualitative data as you conceived and planned the startup. I certainly did. As you continue doing this, make a point of recording the data you collect. Apart from anything else, it will provide good indicators about what you don’t know and what kind of hard numbers will be important to collect before, and maybe also after, launch.

A good idea is to get a handle on what stakeholders you will have as a business. It could be useful to brainstorm with others to get insights that you may have missed. Do everything you can to reduce risk to startup safely. When you have homed in on what data is going to be either vital or revealing, then create a document to organize and prioritize subjects and sources.

Stock Market Performance Unlikely to Impact Startup Decisions

Stock market performance is not a good indicator for startups. Even though about 60 percent of Americans have money  invested in the stock market. (individual stocks, mutual funds, 401Ks/IRAs), according to Gallup (May, 2023). So in economic terms, the market must be important to the majority of Americans.

invested in the stock market. (individual stocks, mutual funds, 401Ks/IRAs), according to Gallup (May, 2023). So in economic terms, the market must be important to the majority of Americans.

However, according to Statista (November, 2023), it’s the top one percent of Americans who own 53.5 percent of stocks and mutual funds. Also, US publicly traded stock comprises 24 percent of the wealth of white, non-Hispanic families, but it makes up only 13 percent of Black wealth and 10 percent of Hispanic wealth (USA Facts, October 2023). In 2022, the largest US ethnic group was white; 58.9 percent; Hispanic: 19.1 percent; Black: 12.6 percent; and Asian: 6.1 percent (Census Bureau).

The vast majority of US businesses, including startups, are small businesses, not quoted firms and employ 61.7 million people. That’s 46.4 percent of all US employees—a large percentage of employees considering that less than 20 percent of small businesses have any employees at all (SBA). Two other facts may be even more significant—non-US citizens own 40 percent of US stocks. Of new listings in 2023, eleven were for foreign owned/based companies from countries as varied as China, Germany, UK, Vietnam and Mexico; they represented 20 percent of all new listings.

Gross Domestic Product Data Are Likely to Mislead Startup Planning

Gross Domestic Product Data are very interesting to macro-economists, but an entrepreneur will most likely be led to delay her startup if GDP is going down, or rush startup plans if GDP is rising. Misreading such aggregated information can result is poor decision making, especially when you know that GDP includes four main kinds of spending: consumer, business, Government and net exports. It influences general confidence, but not necessarily behavior of your particular market.

startup if GDP is going down, or rush startup plans if GDP is rising. Misreading such aggregated information can result is poor decision making, especially when you know that GDP includes four main kinds of spending: consumer, business, Government and net exports. It influences general confidence, but not necessarily behavior of your particular market.

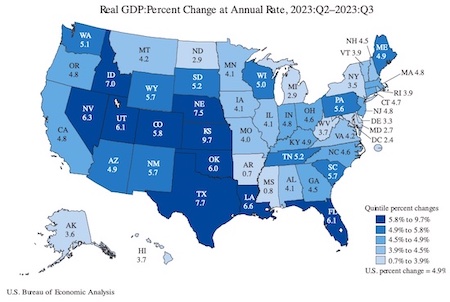

Data specifically relevant to the startup’s location or products being worth tracking. For example, the economy in your state by comparison with others could be significant for success, as is indicated by the chart of state-by-state GDP, where it shows Arkansas had an annual growth rate of 0.7 percent compared with high performing Kansas with a 9.7 growth percent for the period.

The data is this breakdown by State comes from The US Economy at a Glance, from the Bureau of Economic Analysis. In the same series, for example there is one for Personal Income by County and Metropolitan Area.

Inflation Rates Not an Indicator for Startup Opportunities

Of course there are many other ‘big economic indicators’, like inflation rates, that economic commentators will say influence your decision on when to launch your business. Most entrepreneurs should ignore them. Inflation affects every business, not just yours. It may be good to know for operations, such as when you are considering changes in product prices, but for strategy and when to launch, not so much.

your decision on when to launch your business. Most entrepreneurs should ignore them. Inflation affects every business, not just yours. It may be good to know for operations, such as when you are considering changes in product prices, but for strategy and when to launch, not so much.

High inflation will likely mean that your cash flow and liquidity may be adversely impacted. However, there are many other specific reasons why your new business is short of ready cash. In the case of my first startup, mentioned above, we were cash poor and loss making, for the first two years of the life of the business. Sometimes we had to seek early payment and for most sales we sought part payment on contract signature.

Key Targeted Data For Startups

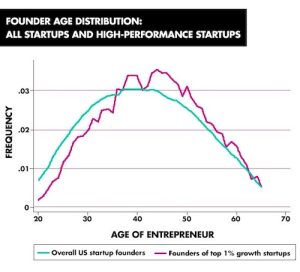

You already know a lot. If you don’t, then you are not ready to be an entrepreneur. Start using your brain. Researchers from the US Census Bureau and MIT found that, contrary to popular thinking, the best entrepreneurs tend to be middle-aged. There are exceptions, but the reason for this is that entrepreneurs of that age have accumulated experience, wisdom and knowledge—and a lot of data.

You already know a lot. If you don’t, then you are not ready to be an entrepreneur. Start using your brain. Researchers from the US Census Bureau and MIT found that, contrary to popular thinking, the best entrepreneurs tend to be middle-aged. There are exceptions, but the reason for this is that entrepreneurs of that age have accumulated experience, wisdom and knowledge—and a lot of data.

There have quite a few studies about the best age to be a founder. While it may be that successful tech founders are younger, most suggest most successful founders are in the 40-50 age range.

be that successful tech founders are younger, most suggest most successful founders are in the 40-50 age range.

This chart shows a very similar pattern between all startups and high-performance startups (Thank you, Ben Jones, entrepreneurship professor). My main startup was launched when I was 43. By that sort of age entrepreneurs will have been collecting relevant data and ruminating about product and market a great deal.

Some the data is anecdotal and it could not be the basis for a Doctorate in business, but you have the learning and it stays with you. Your passion will have led you to talk with many relevant people and listening intently you will have garnered much highly relevant data in addition to the aggregated national economic and market data you pick up along the way.

Ten Kinds of Data to Focus on Your Own Startup

Here are ten kinds of data to focus on your own needs. They will help you get to startup, stronger or sooner. They will also be important in the early stages after startup as conditions push you to modify strategies or change tactics.

Whether you have a formal business plan, or one on the back of a napkin: consider these data strategies to help you maximize your chances of startup success:

- Build a catalog of competitive products/businesses that may exist to fulfill the same or similar purpose as your own. This will not only give you information on potential sales prospects and the sales strategy of possible rivals, but also enable you to build a data-bank about what feature/benefits are currently on offer or planned.The SBA publishes an annual Small Business Profile of each US State.

- Develop a client/customer profile, not just from experience, but visit prospects and probes. Check assumptions and confirm facts. Include subjective and hard information If you intend selling to other businesses, for example, you might want your profile to focus on the top 100 that you can imagine as customers. Even help your profile by visiting them, their suppliers or customers to test out hypotheses.

- Go to the other extreme and consider megadata and how you can break it down to get the kernels you want; It may include some of the data series I describe above as inappropriate for your startup. You will probably need help in drilling down through it to get data targeted enough to be helpful for understanding your specific opportunity. Maybe think about talking with ‘experts’ like academics, market researchers and others.

- Search for and log details of any competitive suppliers. Contact them and see what they offer and try to get printed or electronic details. I was lucky with my 1981 startup, since there was only one. I was able to speak with a few of their customers to get a feel for the way they approached sales and customer support.

- Use experimental means to collect potential customer/user data. If you are aiming at B2C, use a pop-up shop to both try out customer reactions and different locations, but more pointedly to collect data, by interacting directly with people in your customer profile. Before jumping into the practicalities, create a table of data needs. In B2B, data collection, opportunities exist though attendance at meet-ups or trade exhibitions and conferences in your field. Since you already have many contacts, use them regularly. You might consider establishing a meet-up yourself.

- Consider data that you might need outside the marketing/prospect arena. Though external finance may not be on your list of requirements, create a catalog of potential sources of finance, including crowdfunding, both in your local community and among prospects and customers (see the Venture Founders Directory of Equity Crowdfunding—USA and other directories of finance sources on the site) identify Government business finance schemes, such as the Treasury’s Small Business Credit Initiative, and State, County or local schemes, both from government and nonprofits; short or long term loan types appropriate to your business. They might include SBA guaranteed bank loans, or lines of credit, especially after the startup is in business; even if you think you ‘know it all’, you might want to look at incubators and accelerators—some have funding and will certainly have good introductions to make; if you are manufacturing or processing your product, you may want to have data on all the possible sources of financing equipment and apart from loans, if a machine is not needed full-time, maybe you can share it with others, just as farmers co-operate on the purchase of big items like combine harvesters, which are not used daily like milking machines. You may resort to invoice factoring, but rates are high and rather unforgiving. Friends and family may need to be tested out, but be sure to have a signed promissory note. Of course, there is the faithful credit card, but my advice is not to use it except as a last resort, given high interest rates. Venture Founders listing of startup finance sources may trigger your data search ideas.

- Local or sector media are a rich source of data. In my State for example, New Hampshire, there is Business NH Magazine. Recent back issues are not to be overlooked. If you are in any part of the furniture business, Furniture Today would be a rich data source, both published and in the heads of the staff who work there, for instance my local daily has a business editor. Though they are based on widely defined sectors, the Census Bureau of Economic Activity

- Employment data: at the startup planning stage, you are probably not thinking too much about hiring any or many people. You may be relying on outsourcing, friends or part-timers to preserve your cash-flow. However, recruitment firms, local, national or specialized, are a rich source of data on the labor market. Zip Recruiter, for example publishes ten sector annual Labor Market Outlooks. Serving mission driven people and employers, Purpose Jobs founded by Ryan Landau is a rich source of data on employment rends and stories. In my own town, for example, Masiello Employment is a source of local employment data, and hence the local business environment. Wellfound is a specialist recruitment firm for startups. The Wellfound Blog has a trove of startup employment data.

- You may not have tapped into local and regional business economic and market data, but there are good and easily tapped sources. Chambers of Commerce or State/Regional/City Economic Development departments will have both qualitative and quantitative data you will be able to access.

- If you have forgotten any of your startup’s stakeholders, it’s worth checking. There are some who may hold data that could be a boon to your strategic thinking. Many will be happy to share those data. As a checklist, see the Stakeholder Strategy Evaluation Tool.