Directory of Funding for Female Founders—USA Growing Sources of Finance for Women-led Startups

Funding for Female Founders: This Directory of Funding for Female Founders aims to help increase these numbers. It is inevitably incomplete, so we would cherish any additions or suggestions for its improvement and expansion: will@venturefounders.com. If you cannot find a suitable source of funding here, it would be worthwhile for you to visit the Directory of Mission Driven Capital—USA.

Funding for Female Founders: This Directory of Funding for Female Founders aims to help increase these numbers. It is inevitably incomplete, so we would cherish any additions or suggestions for its improvement and expansion: will@venturefounders.com. If you cannot find a suitable source of funding here, it would be worthwhile for you to visit the Directory of Mission Driven Capital—USA.

According to TechCrunch, female-founded companies in the U.S. raised $44.4 billion out of the $170.59 billion in venture capital allocated in 2023. About a quarter of all VC funding went to mixed-gender startup teams. As a mere man, I am very pleased with the trend and am very grateful that my main startup, back in 1982, was with a female co-founder.

The 2024 Impact of Women-Owned Businesses found that women in the US own 14,017,000 businesses representing 39.1% of all businesses, employing 12,164,000 million people and generating $2.7 trillion.

The US Census Bureau reports that a higher share of Black-owned businesses is women-owned than non-Black businesses. In 2021, Harvard Business Review reported that 17% of Black women are in the process of starting or running new businesses. That’s compared to just 10% of white women, and 15% of white men.

Female entrepreneurs own 38% of all businesses in the US, but that is not reflected in the proportion of startup money that currently goes to female founders. But the situation is far from static. The Directory itself shows a growing number of funding sources. As a mere man, I am very pleased with the trend and am eternally grateful that my main startup was with a female co-founder.

Women founders often have to be pathfinders and activists, but men would be well advised to see the disadvantage that they create not only for women, but also for themselves. Of course, not all men are gender prejudiced, but the economic system we inhabit supports any tendency that we men may exhibit by not challenging the system that is letting us down!

Funding for Female Founders—a Fast-Growing Field

Given that women are more likely to start businesses men, according to SCORE, it’s not surprising that funding for female founders is a growing field, but there is nothing precluding women from going to non-gender specific sources of finance. A significant announcement was made by Constellation Brands (December 2018) about their Focus on Female Founders Program, which is scheduled to make a $100 million investment in women-led startups by 2028. They have already provided funding for female founders, in Austin Cocktails, Vivify Beverages and Archer Roose.

“Our Focus on Female Founders program reinforces our commitment to supporting the advancement of women within our company, within our industry, and in our local communities.” In addition to an infusion of capital, funding recipients will have access to Constellation’s experienced staff and hands-on mentors; brand-building, supply chain, governance and finance expertise; strong relationships with distributors and retail partners; and a community of fellow women entrepreneurs who can share knowledge and offer support.

My own personal view is that new ventures with both male and female co-founders produce a more balanced way of doing business, than single gender founded firms. You might want to read my piece on Founder Team Balance, that explains the benefits.

The Federal Government Helps, Too

The Small Business Administration includes the Office of Women’s Business Ownership, which enables and empowers women entrepreneurs through advocacy, outreach, education and support. The SBA has several training and funding opportunities available specifically for women-owned businesses.

The SBA also has a number of initiatives to help women secure better access to Federal procurement opportunities, a much overlooked opportunity. In addition, the BSA works with federal agencies to increase contracting opportunities and achieve the government’s 5 percent contracting goal for women-owned small businesses. There’s help on Venture Founders, as well—take a look at Public Contracts for Small Business.

Research on Funding for Female Founders

Laura Huang and colleagues at Harvard business School have done research on the cognitive and social forces that influence entrepreneurial investment decisions. They have found that VCs tend to ask men ‘promotion-focused questions’, like “where do you see this market going?” Whereas women were more often asked ‘prevention questions’, like “what do you think it will take to break even?” This tended to result in those asked prevention questions only being able to raise $500K, whereas those asked the promotion questions went on to raise up to $7.9 million! The researchers suggest that if you are asked prevention questions, by all means answer them, but rapidly shift the discussion to promote the potential of your business.

VC investment in female startups is clearly, and rightly, a fast growing sector of activity. These are the 70 plus investors I have identified so far in this directory of funding for female founders. I am sure I’ve missed some—and new ones are being created regularly. Women start businesses at a rate one and half times higher than the national average and dominate the workforce holding 56 percent of professional jobs.

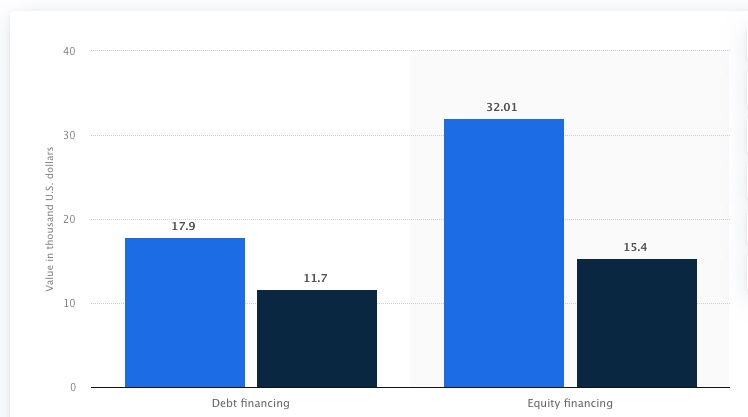

Debt by Contrast with Equity Funding

It is interesting to note that different proportion of debt and equity financing raised by male-led and female-led startups worldwide in 2020. For whatever reasons, female founders relied more on debt than equity financing of their startups, according to Statista.

Directory of Funding for Female Founders

- 37 Angels: activates the untapped capital and experience women can bring to investing in male and female-led ventures. When they started, 13% of angel investors were women. They want that number to be 50%.

- 500.co: a venture capital firm with more than $1.8 billion¹ in assets under management that invests early in founders building fast-growing technology companies.

- Aliavia Ventures: early stage venture capital investing in US and Australian female founders building enterprise and consumer tech companies.

- Aligned Partners: an early stage venture investor with two female co-founders.

- Amplifyher Ventures: invests in diverse leadership teams with a unique ability to create flywheel effects of growth in new markets.

- Angel Academe: investments must have an innovative solution to an important global problem in areas including healthtech, AI/machine learning, data analytics, fintech, cybersecurity or edtech, as well as at least one woman in the founding team.

- Aspect Ventures: long term investors founded by women tech entrepreneurs.

- Astia Angels: an international network of female and male investors that invests in high-growth women-led ventures.

- BBG Ventures: (Built By Girls)an early stage fund focused on consumer internet and mobile with at least one female founder.

- Backstage Capital: Backstage Capital has invested more than $2M in 50+ companies led by underrepresented founders: women, People of Color, and LGBTQ.

- Belle Capital USA: is an early stage angel fund focused on building companies in underserved capital markets, with at least one female founder or C-level exec, and/or be willing to recruit top female talent to the C-suite and Board of Directors.

- Black Girl Ventures: provides Black/Brown woman-identifying founders access to community, capital, and capacity building to meet business milestones.

- Broadway Angels: all of whom just happen to be women and invests in the best entrepreneurs and companies while showcasing the top women investors in venture capital and technology.

- Brooklyn Bridge Ventures: leads or co-leads investments of around $350,000 in New York City area, and high proportion of portfolio made up of female-founded startups.

- Cannan Partners: based on both east and west coasts, a high proportion of staff are women and 40% of investors are women. Across healthcare and technology, they partner with companies that improve lives.

- Community Development Financial Institutions – or CDFIs – are mission-driven financial institutions that are dedicated to providing financial services to meet the needs of economically disadvantaged individuals within underserved communities.They are particularly available to women and while not all CDFIs do, most will lend to startup businesses. Find a Directory here.

- Ceres Venture Fund: with three female managing directors, invests in high growth companies located in the Midwest in their early stages of growth.

- Cartier Women’s Initiative Awards: an international business plan competition created in 2006 by Cartier, the Women’s Forum, McKinsey & Company and INSEAD business school to identify, support and encourage projects by women entrepreneurs.

- Chloe Capital: a venture capital firm that invests with a gender and diversity lens.

- Cleo Capital: a generalist venture capital fund founded by general partner Sarah Kunst in 2018.

- CNote is an investment platform intended to build a more inclusive economy through financial innovation. The company’s platform directs every dollar invested towards funding females, minority-led small businesses, affordable housing, and economic development in financially underserved communities across America.

- Cowboy Ventures: helps seed-stage technology companies grow; the female founder was previously at Kleiner Perkins Caufield & Byers. They help seed-stage technology companies grow, backing exceptional founders who are building products that “re-imagine” work and personal life in large and growing markets.

- Emmeline Ventures: invest in female founders building game-changing businesses which empower women, in particular, to manage their health, build their wealth, and live in a cleaner, safer world.

- EY Entrepreneurial Winning Women: a national competition and executive leadership program that identifies a select group of high-potential women entrepreneurs whose businesses show real potential to scale-and then helps them do it.

- F-cubed, invests in the exponential power of exceptional women-led ventures, focused on e-commerce, media, platforms, advertising, web-enabled services.

- Female Funders: world’s first online education programs for aspiring female angel investors and entrepreneurs looking to raise seed capital.

- FirstMark Capital: an early stage venture capital firm based in New York City. They say, “we have been humbled to see the dramatic impact that startups can have on the world.”

- Forerunner Ventures: the female founder is managing director, Kirsten Green, defines itself as a “female VC firm” that focuses on early-stage investments in “innovative, vertically integrated brands”.

- Golden Seeds: a discerning group of investors, seeking and funding high-potential, women-led ventures; have invested in over 65 women-led enterprises.

- Gotham Gal: an early-stage angel investor, entrepreneur, and philanthropist with a diverse background in retail, wholesale, media, real estate and technology.

- Halogen Ventures: an early stage venture capital fund investing in consumer technology companies led by women.

- How Women Invest: Investing exclusively in women-led companies.

- IFundWomen: plenty of advice and help, including a crowdfunding platform exclusively for women.

- Illuminate Ventures: in the B2B/Enterprise cloud and mobile computing space; the female founder is the managing partner.

- Impact Engine: a women-owned VC, whose mission is to bring more capital to a market where financial returns are linked to positive social and environmental impacts.

- Intel Capital Diversity Fund: the largest venture capital fund ever created to focus on female and underrepresented minority tech entrepreneurs.

- January Ventures: unlike most VCs, They invite women to make direct pitches.

- Jump Fund: invests in women’s capital in female-led companies with growth potential in order to generate a strong financial return and elevate the role of women in business, with a mission is to seed and grow strong, female led ventures in the Southeastern, US.

- Jumpstart Focus Fund: invests seed capital in tech-based companies led by female entrepreneurs and entrepreneurs of color throughout Ohio – as well as those willing to move to the state.

- LDR Ventures: makes early stage investments in exceptional female and minority founders at the Seed & Series A Stages.

- Merian Ventures: invests in women founded and co-founded innovation in cyber, blockchain, artificial intelligence (AI), machine learning (ML), and consumer-facing companies.

- New Voices Fund: The $100m fund directly invests in businesses owned by women of color entrepreneurs; is a B Corp.

- Pipeline Angels: a network of new and seasoned women investors, is changing the face of angel investing and creating capital for women and non-binary femme social entrepreneurs.

- Plum Alley: aims to increase the amount of capital going to female founded startups and gender balanced teams by expanding the number of women and men who invest in private companies.

- Portfolia creates investment funds designed for women, backing innovative companies we want in the world for returns and impact.

- Rethink Capital: impact venture capital firm investing in gender diverse leadership teams that are using technology to solve the world’s biggest problems.

- Rivet Ventures: Shadi Mehraein & Rebecca Hwang the cofounders invest in companies in women-led markets where female usage, decision-making, and purchasing are crucial to company growth. They back both male and female founders.

- Salesforce Ventures Impact Fund: One focus is on equality: it invests in companies developing tools to promote equal opportunity and economic empowerment for women & underrepresented groups.

- Scale Venture Partners: a Silicon Valley-based firm that invests in early-in-revenue technology companies that are looking to scale, where one of the co-founders is a woman.

- Sequoia Capital: where Jess Lee is the first woman investing partner; they claim to help the daring build legendary companies.

- Sogal: a platform that empowers emerging entrepreneurs to succeed, and a community that unites global young founders to change the world.

- Spark Capital: where Megan Quinn is one of the General Partners, having joined from Kleiner Perkins Caufield & Byers; Spark invests in creative thinkers.

- Springboard Enterprises: a highly-vetted expert network of innovators, investors and influencers who are dedicated to building high-growth technology-oriented companies led by women.

- Starvest Partners: a New York City-based growth equity firm investing in technology-enabled, business-to-business services companies, with a sector focus on Software-as-a-Service, Data & Analytics, E-Commerce Infrastructure, and Digital Marketing Services—one of the largest women-owned VC funds in the US.

- The Helm: has invested nearly $1.5M of seed capital in 11 female-founded US companies, ranging from wearable tech and agro-tech to maternal health and design. Their second fund and new investor membership community aims to make investing in female entrepreneurs more accessible.

- The Refinery: fuels the growth of early stage companies with at least one woman in a leadership role. The Refinery provides the tools, resources and capital for smart women to build great companies.

- Tory Burch Foundation: their program with Bank of America offers access to affordable loans through Community Lenders (including, for example, The People Fund, a Texas CDFI)

- Triton Ventures: founded by Laura Kilcrease in Austin, TX. Their investment focus is on spinout companies.

- Valor VC: founded by Lisa Calhoun and based in Atlanta, they invest in fintech, healthtech, and consumer tech entrepreneurs, specially those with game-changing technologies that simplify people’s lives—if there is a woman or minority person among the founders with at least 10% of the equity.

- WE Capital: a consortium of leading businesswomen deploying capital to empower the next generation of female entrepreneurs changing the world.

- Women’s Capital Connection has 3 founding investors committed to investing in women-led ventures in the Kansas City region.

- Women’s Financial Fund: awards grants to new and existing businesses from $100 to $5,000.

- Women’s Venture Capital Fund: invests in women-led ventures leading gender diverse teams and creating high growth companies in digital media and sustainable products and services.

- Women’s Venture Capital Fund: capitalizes on the expanding pipeline of female founders leading gender diverse teams and creating capital efficient, high growth companies in digital media and sustainable products and services.

- Women’s Venture Fund: a nonprofit organization that helps women to establish thriving businesses in urban communities with funding and business development programs.

- xElle Ventures: based in North Carolina, xElle offers debt finance ($25-100K) using a unique process of a pitch to its members.

- XFactor Ventures: focused on making pre-seed and seed stage investments in companies with billion dollar market opportunities that have at least one female founder.

- X Squared Angels Group invests in women-led startups, primarily in high-potential early-stage companies in IT, software, bioscience, advanced materials, medical devices, and most other markets located in Ohio as well as the rest of North America.

- XXelerate Women: supports high-performing women entrepreneurs leading growth companies by providing access to the debt financing that growing in-revenue businesses need, and the financial education, mentorship, and peer support necessary to scale efficiently and profitably.

If you don’t find what you are looking for here, many additional sources are listed on Mission Driven and Purpose Capital Directory—USA.

A Guide to Women- and Minority-Owned Business Funding Opportunities, a report by US Senator Kirsten Gillibrand of New York is a useful guide to most of the Federal programs aimed at funding for female founders.

The Majority Report of the US Senate Committee on Small Business and Entrepreneurship, 21st Century Barriers to Women’s Entrepreneurship, also is interesting reading. The report points out that while Government has never met its goal of awarding 5 percent of Federal contracts to women-owned businesses, if they did, women-owned businesses would have access to marketplace opportunities worth at least $4 billion each year. Even better is if you can get what is called an 8a registration, since in the Federal ‘Set-Aside’ system there are only 5,000 or so 8a vendors, whereas there are 70,000 women registered. To bid on government contracts, you need a (free) DUNS number, and to know your North American Industry Classification System (NAICS) Code Number.

A kind correspondent, Stacy Martin told me about an excellent Guide to Women in Business on the Maryville University website, that her daughter Christine had found. It has some very good links.

Another kind commentator, Anna Jones, a Media Specialist at a library near Seattle suggested I add a link to https://www.zenbusiness.com/info/resources-for-women-in-business/. A very good suggestion, too. Zen Business is a partner for business owners who want a solution to the challenges of starting, running, and growing a business. They use technology and automation to provide fast and low-cost services, expert support, and a personalized dashboard. For instance they can set up your business registration in any state, but the link above covers gender inequality in the workplace, and I’m sure female founders will find lots of value there, as well as helpful inexpensive services.

Here is another very helpful resource: Information, Grants, and Resources for Women That Own Small Businesses. Take a look.

NOTES:

- If you make contact with any of these organizations, it would be very kind if you would tell them that you came to know about them through the Directory of Female Founders. Thank you.

- This Directory has been prepared and written by a man. I make no apologies and look forward to many corrections and improvements from women.